Distributors Continue to Be Resilient in The Face of Ongoing Supply Chain and Economic Concerns

2022-Q3 SOLOMON COYLE MARKET OUTLOOK REPORT

The Solomon Coyle 2022-Q3 Market Outlook Report is now available. Dealers that participated should check their inbox for the email announcement which contains access information for the full report.

Key findings this quarter cite the following:

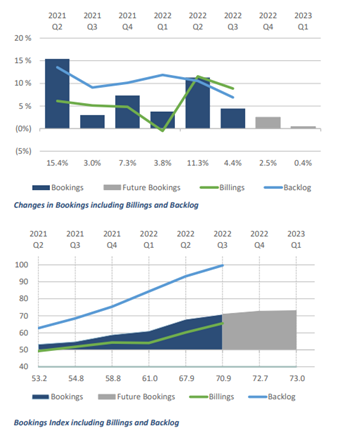

- The current survey has captured a 4.4% increase in Q3’22 bookings over Q2’22, better than the expected 3.2% increase previously forecasted. This suggests some pent-up demand is still positively impacting dealers in bookings.

- Dealers see bookings growth increasing 2.5% in Q4’22 over Q3’22 and forecast an increase of 0.4% in Q1 of 2023 over forecasted Q4’22 levels.

- Billings grew significantly, with the index increasing from 60.2 to 65.6. This would indicate that dealers are employing best practices in progress payments, deposits, and effective terms and conditions, thus countering supply chain and construction delay realities.

- The backlog index is at 99.7 as compared to 93.2 in the Q2’22 results, which is the highest point in the last three years, pre- and post-pandemic. This impacts storage availability, job completion, invoicing, and cash flow.

- There is a slight slowdown in pipeline activity in most regions, sectors, and product categories, likely due to economic uncertainty, delayed decisions, and diminishing pent-up demand. With the notable exceptions of the furniture product category and the government, hospitality, and tech sectors, pipeline growth is slowing.

Head of Business Analytics for Solomon Coyle, John Joseph, shares, “The sector pipeline breakdown is flashing a concerning signal this quarter. The strongest pipelines are in government, education, and healthcare, which historically respond slowest to market downturns. We will be keeping a very close eye on this in the coming months.”

Distributors that complete the quarterly survey receive a full report containing regional and subregional information, where available.

Distributors that complete the quarterly survey receive a full report containing regional and subregional information, where available.

To view the current report, visit: www.solomoncoyle.com/dealer-market-outlook-report/. For inquiries regarding participation, email support@solomoncoyle.com.